Operating Rental

In a nutshell, an operating rental is a cost-effective method of utilising an equipment asset without having to initially outlay the purchase price of equipment; it is a form of acquiring equipment in which capital expenditures are kept off the Balance Sheet. |

|

|

Redirect Cashflow

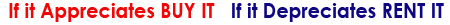

Rental allows customers to redirect their cash to income – generating assets, projects, property, etc. rather than assets that depreciate in value, whilst at the same time spreading the cost of the rented equipment over it's full life.

In contrast to loans, debt and equity – which do appear on the balance sheet, operating rentals are one of the most common forms of off-balance-sheet financing.

|

|

|

Tax Benefits

With no deposits, and the ability to achieve maximum off-balance sheet tax benefits, and at the same time upgrade and track technology, it's not the smarter choice to productive business, but the only choice.. |

|